Irc Section 704 B

Now the value of property contributed by b will have the following basis.

Irc section 704 b. Section 704 b of the internal revenue code provides that a partner s distributive share of income gain loss deduction or credit is determined in accordance with the partner s interest in the partnership if the partnership agreement does not provide as to the partner s distributive shares of these items or the allocation to a partner of. To calculate the depreciation of the depreciable property under section 704 b it should have the same ratio as tax depreciation has to the tax basis unless it is done according to the remedial. Section 1 704 4 d 2 provides that the transferee of all or a portion of the partnership interest of a contributing partner is treated as the contributing partner for purposes of 704 c 1 b and 1 704 4 to the extent of the share of built in gain or loss allocated to the transferee partner.

Section 201 b 2 of pub. Read the code on findlaw. 527 providing that 1 section 704 c 1 b applies to newly created section 704 c gain or loss in property contributed by the transferor partnership to the continuing partnership in an assets over merger but does not apply to newly created reverse section 704 c gain or loss resulting from a revaluation of property in the.

In the case of a loss which was not allowed for any taxable year by reason of the last 2 sentences of section 704 d of the internal revenue code of 1986 formerly i r c. For example if a and b each contributed 100 allocations would be in accordance with the partners interests in the partnership if all partnership items are shared 50 50. 95 600 as amended by pub.

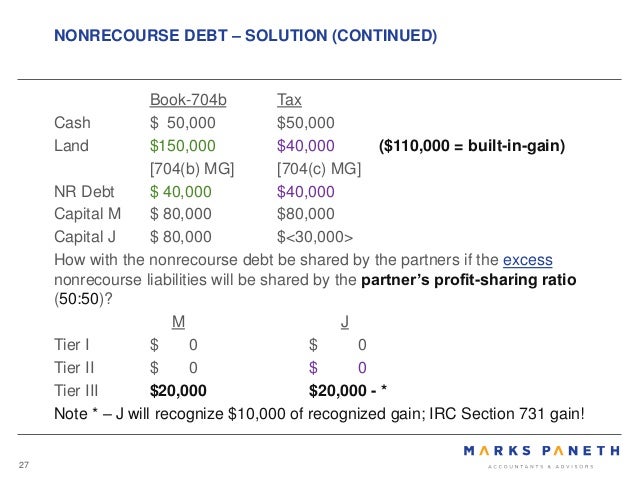

1954 as in effect before the date of the enactment of this act nov. 700 for gaap 400 for tax purposes and 1 000 for section 704 b. 22 1986 100 stat.

Liquidating distributions can be made in accordance with the partners respective interests in the partnership. Internal revenue code 26 usca section 704. Allocations to partners webinar 9.

Although section 704 b does not directly determine the partners distributive shares of tax items governed by section 704 c the partners distributive shares of tax items may be determined under section 704 c and 1 704 3 depending on the allocation method chosen by the partnership under 1 704 3 with reference to the partners. While all depreciation is generally shared 50 50 section 704 c principles require that the first dollars of tax depreciation be allocated to the non contributing partner b until b has received.