Section 382 Statement Example

The statement must include the date s of any owner shifts equity structure shifts or other transactions described in 1 382 2t a 2 i the date s on which any ownership change s occurred and the amount of any attributes described in 1 382 2 a 1 i that caused the corporation to be a loss corporation.

Section 382 statement example. Assume an acquirer purchases all the stock of lossco for 100. Assume also that the long term tax exempt rate is 2. An individual that previously did not own stock of the loss corporation acquires 52 percent of the stock via a tender offer.

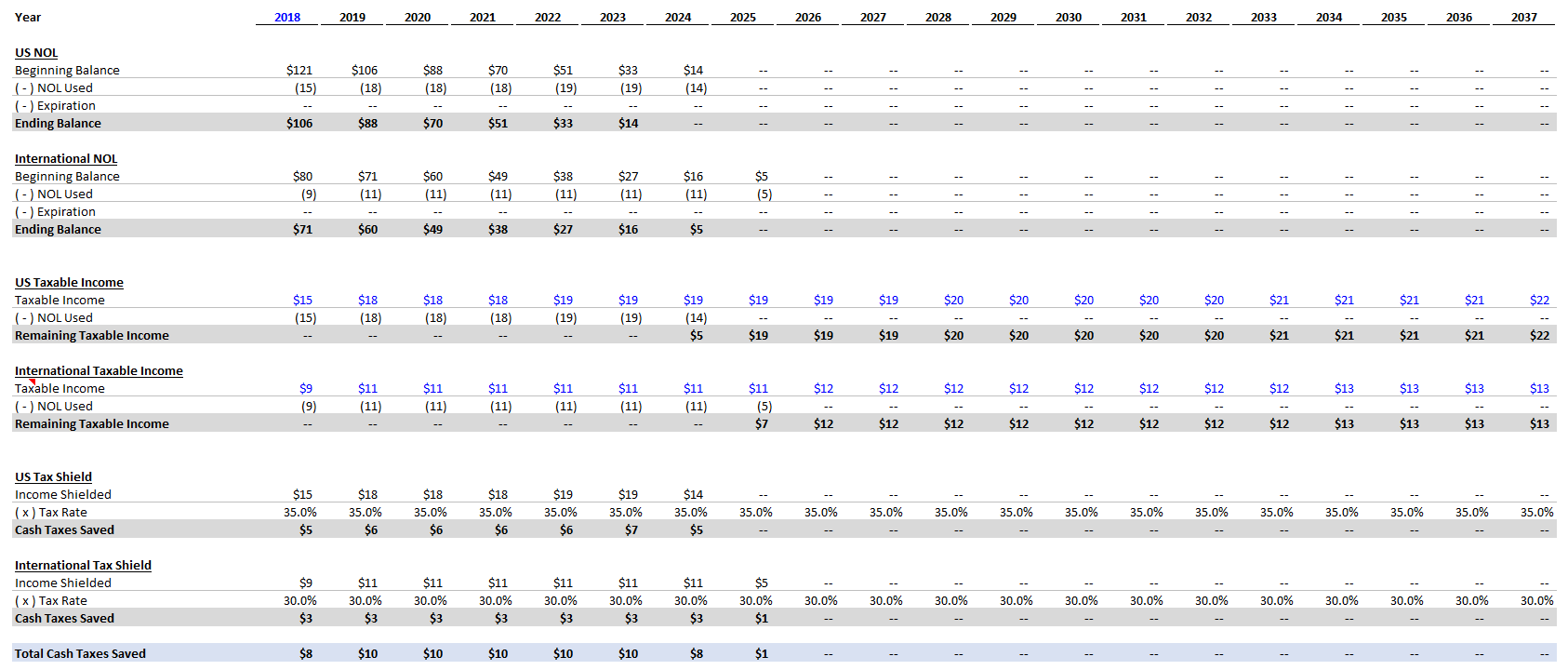

Under section 382 of the irc a c corporation is required to have a limit to offset historic losses. At the closing the company shall cause the dlj entities to deliver to the buyer a statement pursuant to treasury regulations section 1 382 2t k 1 ii signed under penalties of perjury by an appropriate officer setting forth a the aggregate ownership by each of the dlj entities of the stock of the company during the period october 11 2000 through the closing date the relevant period b the number of partners in each of the dlj entities that owned. The irc 382 lays down the guidelines for the amount of taxable income that can be offset by historical losses known as a tax loss carry foward nol tax loss carryforward firms use an nol tax loss carryforward to carry forward losses from prior years to offset future profits and lower future income taxes this t akes place after a company has undergone a.

A loss corporation may also be required to include certain elections on this statement including. Section 382 generally limits the use of nols and credits following an ownership change which occurs when one or more 5 percent shareholders increase their ownership in aggregate by more than 50 percentage points over the lowest percentage of stock owned by such shareholders at any time during the testing period generally three years. Following the tender offer the individual is a 5 percent shareholder whose percentage.

Congress enacted section 382 to prevent a corporation with a large taxable income from purchasing a company with net operating losses nol carryforwards and using those acquired nols to offset income. Provisions of this section apply when there is a change in the ownership of a c corporation with accumulated nol carryforwards. Period i r c 382 g 1.

In the case of a texas corporation incorporated on july 23 1935 in applying section 382 of the internal revenue code of 1986 as in effect before and after the amendments made by subsections a b and c to a loan restructuring agreement during 1985 section 382 a 5 c of the internal revenue code of 1954 as added by the amendments made by subsections e and f of section 806 of the tax reform act of 1976 shall be applied as if it were in effect with respect to such restructuring. As a summary c corporations are those under us law that are taxed separately from their owners. The section 382 limitation is determined by multiplying the value of the loss corporation s equity before the ownership change by a specified rate that is determined each month by treasury and the irs.

For example some taxpayers have interpreted more general provisions of the regulations to require the valuation of all outstanding shares of stock of a corporation on every testing date. Irc 382 for tax loss carryforwards. Under this interpretation the effect of 382 l 3 c is limited to ensuring that a testing date does.