Section 32 Property

Wakelin property advisory director paul nugent says the copy of title is the single most important document attached to a section 32.

Section 32 property. Eligible properties must pass a housing quality standards hqs inspection. It is important to remember that a section 32 statement is not a contract of sale. This document must be handed over to the intended purchaser of the property.

He says it proves the vendor s right to sell the property and dictates in a legal sense exactly what the property is whether it a block of land a house or an apartment. It s a legal document given by the seller of a property to the interested buyer. Section 32 hcm hoepa breakdown including cfpb january 1 2014 2016 updates hoepa 12 cfr 1026 32 high cost mortgage loans general 2013 cfpb tila amendments apply to borrowers that purchase or already own their homes and entered into loans that met or exceeded specific cost parameters.

Essentially this document contains all the information about the property that is required by law that the seller must provide to the buyer. The section 32 is a legal document provided by the seller vendor to an intending purchaser. A person is not relieved of the obligation because he no longer owns the property.

A section 32 or vendor s statement is a document that discloses any information that could affect the land being sold in a property transaction. The purchase price will be the current within 6 months of purchase appraised value of the home. Section 32 homeownership is offered to first time homebuyers who are at or below 80 area median income ami and who will use the home as their primary residence.

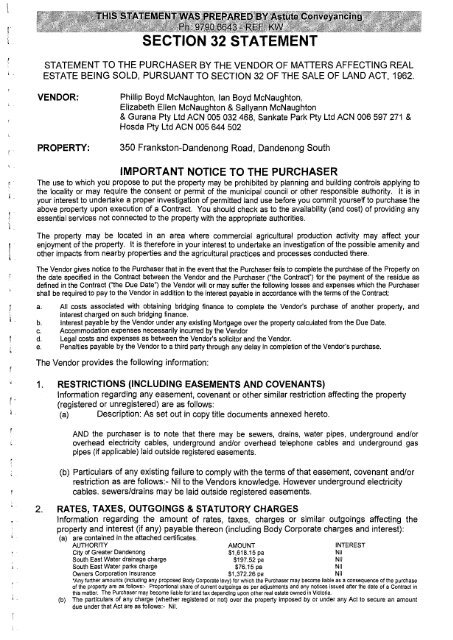

A section 32 vendor statement refers to the legal document given by the seller to the potential buyer. The name is derived from section 32 of the sale of land act in victoria. The section 32 statement is an important part of any real estate transaction.

A except as provided by subsections b and c of this section property taxes are the personal obligation of the person who owns or acquires the property on january 1 of the year for which the tax is imposed or would have been imposed had property not been omitted as described under section 25 21. Personal liability for tax. A section 32 statement aka vendor s statement is a document provided by a vendor when they decide it s time to sell their property.